Introduction

Hong Kong has officially entered the global competition for intellectual property (IP) development with the introduction of its Patent Box Scheme. The regime, legislated through the Inland Revenue (Amendment) (Tax Concessions for Intellectual Property Income) Ordinance 2024, was enacted on 5 July 2024 and applies retrospectively from the year of assessment (YOA) 2023/24.

Under this scheme, qualifying taxpayers can enjoy a concessionary 5% profits tax rate on eligible IP income derived from research and development (R&D) activities. This is a significant reduction from the standard Hong Kong profits tax rate of 16.5%, making the regime one of the most competitive IP-related tax incentives in Asia.

The new tax incentive not only bolsters Hong Kong’s status as a global innovation hub but also encourages enterprises across technology, biotechnology, creative industries, and manufacturing to develop and commercialize their IP locally.

Legislative Background

The Commerce and Economic Development Bureau (CEDB) first issued a consultation paper in September 2023 proposing the introduction of a Patent Box in Hong Kong. After public consultation and legislative scrutiny, the government gazetted the Ordinance in July 2024.

Key objectives of the legislation include:

• Promoting IP creation, protection, and commercialization in Hong Kong.

• Attracting multinational corporations and startups to centralize their R&D and IP activities in the city.

• Aligning with the OECD’s Base Erosion and Profit Shifting (BEPS) Action 5 Report by ensuring compliance with the nexus approach.

• Enhancing Hong Kong’s competitiveness vis-à-vis other regional innovation hubs such as Singapore, Ireland, and Luxembourg.

The 5% Concessionary Tax Rate

The highlight of the Patent Box Scheme is the 5% profits tax rate on eligible IP income. This concessionary rate applies to:

• Royalty and licensing income

• Income from sale of eligible IP assets

• Embedded IP income (where part of a product/service price reflects IP value)

• Insurance, damages, or compensation relating to IP

This rate positions Hong Kong among the most attractive jurisdictions for IP taxation. For context:

• Luxembourg: 4.99%

• Ireland: 6.25%

• Singapore: 5% or 10%

• Israel: 5% to 16%

• Korea: 4.5% to 18%

With no sunset clause and no pre-approval requirement, Hong Kong’s scheme is simpler and more flexible than many overseas counterparts.

Who Can Benefit?

Eligible Persons

The scheme is not restricted to IP owners. Any “eligible person” deriving income from qualifying IP may benefit. This includes:

• IP owners holding patents, copyrights, or plant variety rights.

• Licensees and sub-licensees with rights to exploit IP, provided they incur eligible R&D expenditure linked to the IP

Eligible Intellectual Property

Hong Kong has adopted a liberal approach in defining eligible IP. Qualifying assets include

1. Patents filed or granted in Hong Kong or overseas.

2. Plant variety rights registered locally or abroad.

3. Copyrighted software, provided it falls within relevant legal protection under Hong Kong or foreign laws.

Transitional provisions allow patents and plant variety rights filed overseas within 24 months (before 5 July 2026) to qualify. Thereafter, only local filings will be accepted to encourage IP registration in Hong Kong.

The Nexus Approach to R&D

Central to the Patent Box Scheme is the OECD’s nexus approach, which ensures that tax benefits are tied to actual R&D activity.

Qualifying Expenditures (QE)

• R&D conducted by the taxpayer in or outside Hong Kong.

• R&D outsourced to unrelated parties globally.

• R&D outsourced to Hong Kong resident related parties.

Non-Qualifying Expenditures (NE)

• Acquisition costs of IP.

• R&D outsourced to related parties outside Hong Kong.

The nexus ratio is calculated as:

Qualifying IP Income = IP Income × QE (+30%uplift) / [QE+NE]

The 30% uplift (capped at 100%) encourages companies to conduct R&D in Hong Kong by increasing the proportion of income eligible for the concessionary tax rate.

Transitional Arrangement

Recognizing the challenges of historical tracking, a three-year rolling basis applies between YOA 2023/24 and 2025/26, allowing taxpayers to calculate R&D fractions without tracing each IP asset individually.

Record-Keeping and Compliance

Taxpayers must maintain detailed records of R&D expenditure allocation and IP income attribution. The Inland Revenue Department (IRD) is expected to issue further guidance, including illustrative examples on:

• Evidence for copyrighted software protection.

• Cost-sharing arrangements (CSA) and their qualification.

• Allocation of R&D expenses across “families of IPs” generated from a single R&D project.

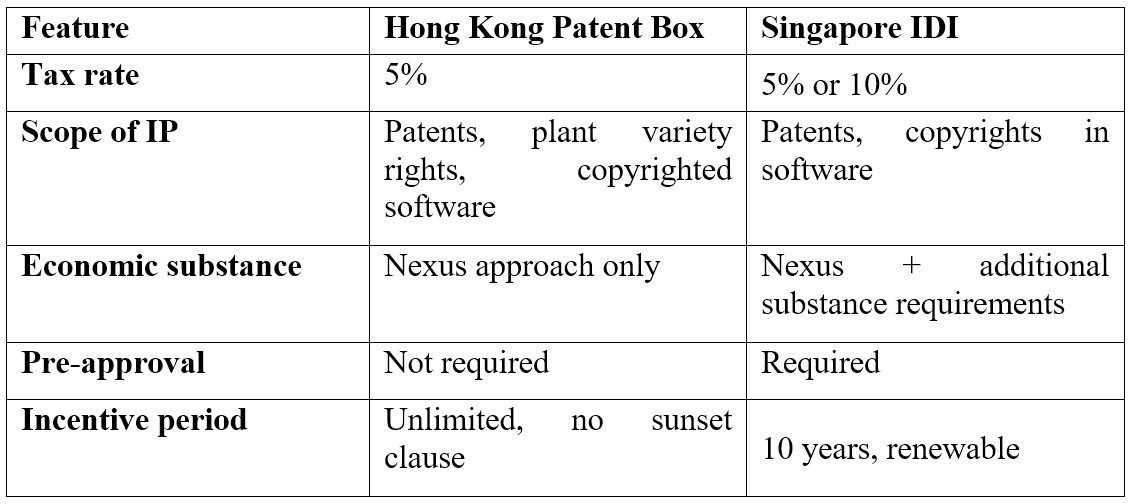

Comparison Between Hong Kong Patent Box with Singapore’s IDI

A high-level comparison highlights Hong Kong’s advantages:

Hong Kong’s lower rate, simplified compliance, and broader IP scope make it more attractive for businesses seeking long-term IP commercialization.

Business Implications

The Patent Box Scheme is set to transform Hong Kong’s innovation ecosystem. Key impacts include:

• Increased IP registration and filings in Hong Kong due to local eligibility requirements.

• Centralization of R&D functions in Hong Kong to maximize qualifying expenditure.

• New opportunities for IP trading and commercialization, especially in biotech, fintech, and creative industries.

• Professional services growth in IP management, valuation, licensing, and tax advisory.

ONC Lawyers recommends that companies:

• Review IP holding structures and consider relocating IP to Hong Kong.

• Strengthen R&D expenditure tracking systems to comply with nexus rules.

• Explore opportunities for embedded IP income attribution to benefit from the 5% rate.

Conclusion

The Patent Box Scheme in Hong Kong represents a milestone in the city’s tax and innovation policy. By offering a 5% concessionary tax rate for R&D-related IP income, the scheme provides powerful incentives for enterprises to innovate, register IP locally, and commercialize technologies from Hong Kong.

Unlike other jurisdictions, Hong Kong’s regime is broad in scope, simple in compliance, and permanent in nature. It enhances the city’s appeal as an IP hub while reinforcing its role in the global innovation value chain.

For businesses engaged in R&D, now is the time to review existing arrangements, maximize eligibility, and seize the opportunities presented by the Patent Box Scheme.

Contact ONC Lawyers now to explore how your business can benefit from Hong Kong’s Patent Box Scheme and secure the 5% tax rate on R&D income.